As we look around the world, we see the need for investment in energy infrastructure. Of course, this is of no surprise. After all, there is no shortage of need (i.e. markets to be satisfied); Businesses, which are depended upon to grow a nation's economy, need energy. Many of the world’s citizens still need electricity. The statistics are shocking. According to the World Economic Forum (WEF), “two in three Africans lack access to electricity” (the population in Africa equates to about 1,284,103,500 people). To make matters worse, according to McKinsey & Company, just as one example, in sub-Saharan Africa, “nearly 70 percent of the population lacks access to electricity,” and those fortunate to have access to electricity “find it unreliable.” Shifting for a moment from Africa to Asia, according to the Asian Development Bank (ADB), almost a billion people in Asia still lack access to electricity (the population in Asia equates to about 4,540,509,966 people). The International Energy Agency (IEA) points out that according to their World Energy Outlook (WEO) Special Report, approximately “65 million people across the ten Association of Southeast Asian Nations (ASEAN) countries are without access to electricity.”

Clearly, there is a need. In fact, the United Nations (UN) codified this need, via the Sustainable Development Goals (SDGs). The SDGs, which were adopted by 193 countries, specified a target to “ensure access to affordable, reliable, sustainable, and modern energy for all.” However, there exists an interesting phenomenon. Even in the growth economies of Africa and Asia (i.e. the most promising of markets), the supply of reliable energy and the demand for it has far outpaced the infrastructure. First, generation is insufficient, and second, the existing electrical power grids need greater resiliency, as they are prone to frequent outages. Yet, the growth economies are not only contending with these stability/resiliency issues, but also an energy-infrastructure investment gap.

According to The New Partnership for Africa's Development (NEPAD) and the Organization for Economic Co-operation and Development (OECD), USD$40.8 billion is currently needed for the power sector in Africa. Another USD$26.72 is required capital expenditure, and still another USD$414.08 billion is needed for operations and maintenance. For the world, according to the World Bank, “the electricity sector represents the second largest infrastructure investment gap [after roads] at $2.9 trillion.” With regards to Asia, according to the ADB, "even if government reforms could bridge up to 40% of this infrastructure gap, the private sector will need to do the rest." The problem rests in the fact that government spending may have topped out. In terms of the current infrastructure investment paradigm in Developing Asia, it is already primarily effectuated by the public sector, which provides “over 90% of the region’s overall investments. This amounts to 5.1% of GDP annually, far above the 0.4% of GDP coming from the private sector.” According to the Under-Secretary-General of the UN & Executive Secretary of the Economic and Social Commission for Asia and the Pacific (ESCAP), “Developing Asia‐Pacific economies are growing twice as fast as the world and the region now accounts for more than 30% of the world’s GDP.” Yet, generation is insufficient, and the existing electrical power grids are brittle and subject to frequent outage. Therefore, there is massive opportunity for improvements, and theoretically, this constitutes a ripe market for investment. So, what is holding back a flood of investment by private sector investors?

Let us examine where the money is needed and flowing. The ADB asserts that “much future infrastructure investment will go to maintenance and rehabilitation costs. The ratio of new investment to maintenance and rehabilitation is 4:3 for baseline estimates.” So, does investment in maintenance, rehabilitation, and other resiliency-related actions generate a high enough rate of return? Let us examine the facts. There are about 65 Energy exchange-traded funds (EFTs) traded on just the U.S. markets (more for the markets of the world), and these Energy ETFs have approximately USD$56.14 billion in assets under management. Energy ETFs tend to invest in those companies for which the majority of their cash flow comes from the higher rate of return areas, such as transportation, storage, and processing of energy commodities. Hence, there has been an underinvestment in the lower rate of return areas of enhancing electrical power grid stability and resiliency.

For certain niches within the commercial sector, Forbes asserts: “more businesses are investing in energy-efficiency measures not because of some green business initiative but because they view it as a smart operational practice. A recent survey by software company Ecova, for example, found that 57% of the roughly 500 executives who responded plan to spend more money and time ... on technologies that help them gain more control over their energy costs.” There does exist the desire to invest in energy infrastructure within particular sector niches. So, how can this desire be fused with the energy-infrastructure investment gap of the involved locale? It is a challenge, but it can be done.

For starters, Vit Tall P3I has been an active player in “priming the pump” and effectuating several of these fusions across the ASEAN.

As a strategic investor of time and money, Vit Tall P3I looks for opportunities related to energy infrastructure, in a value-added contributory fashion, to fill an energy-infrastructure knowledge investment gap and meet a societal need.

As discussed, there are about 65 Energy exchange-traded funds (EFTs) traded on the U.S. markets, and these Energy ETFs have about USD$56.14 billion in assets under management. Management expert Peter Drucker often proclaimed, “If you can't measure it, you can't manage it.” This applies well to the energy sector, for in the energy sector, one can measure it, validate it, analyze it, and action it.

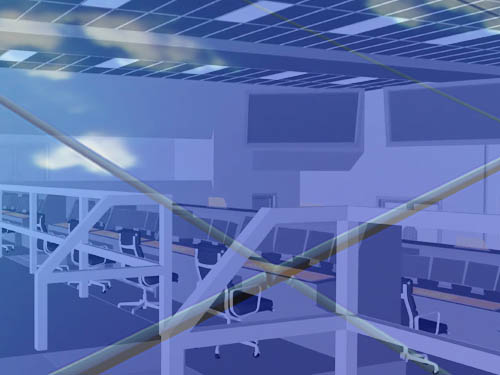

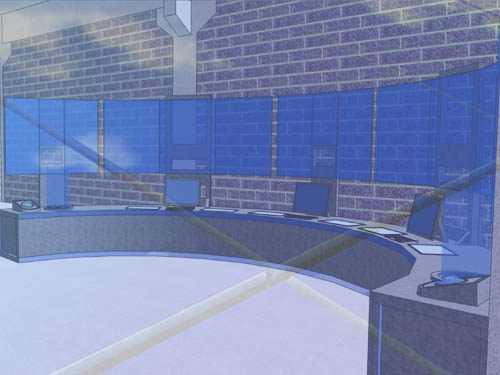

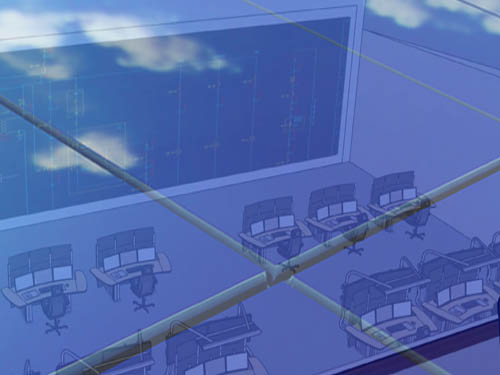

For that reason, Vit Tall P3I has determined that its core mission is to engage with those sectors that have focused upon measuring telemetry data from the electrical grid and — to further this paradigm as well as operationalize it — analyzing that data.

Vit Tall P3I has had the privilege and honor of engaging with the Association of Southeast Asian Nations (ASEAN) countries of Indonesia, Laos, Malaysia, Philippines, Singapore, and Thailand. These engagements have included embassy venues, development delegations, investment coordinating board venues, and one-on-one meetings. To date, Vit Tall P3I has placed investments within Indonesia, Laos, Philippines, Thailand, and Japan. Vit Tall P3I is deeply honored to have had a rich heritage of active engagements, collaborations, partnerships, and friendships within these countries.

The interconnections of a global economy have segued to an interesting phenomenon of “Joint Critical Infrastructure.” Major power outages have struck airlines and airports around the world. When this happens, passengers all around the globe feel the impact of delayed and/or cancelled flights. As airlines have streamlined their operations by using various hubs at airports (a.k.a. airline hubs), the ripple effect of power outages at these airline hubs can be quite profound. Accordingly, many countries have looked at airlines and airports as constituting “Transnational Critical Infrastructure” or “Joint Critical Infrastructure,” as disruptions could have a bearing upon all their respective Gross Domestic Products (GDPs). Similarly, many countries have looked at the light rail transits (LRTs) that connect these airports to their cities as also constituting “Joint Critical Infrastructure.”

In recent times, power outages have affected numerous airports, airlines, and LRTs. More than 50 airports across Japan, which is the host country of the upcoming Tokyo 2020 Olympics, were affected when the national airline carrier, All Nippon Airways (ANA), experienced an outage of its information technology (IT) systems on 21 March 2016. On 13 June 2017, a power failure delayed Garuda Indonesia flights at Soekarno-Hatta International Airport’s Terminal 3 in the Greater Jakarta area on the island of Java in Indonesia, which is the host of the upcoming 2018 Asian Games, the second largest multi-sport event after the Olympic Games. Power outages had also affected: the Delhi Indira Gandhi International Airport in Delhi, India on 8 Feb 2013; the Tan Son Nhat International Airport in Ho Chi Minh City, Vietnam on 20 Nov 2014; the Manila Ninoy Aquino International Airport in Manila, Philippines on 3 April 2016; the Krabi International Airport in Krabi, Thailand on 8 August 2016; the Akita Airport in Akita, Japan on 27 November 2017; and the Tokyo Monorail Co. monorail service connecting Tokyo’s Haneda airport and the downtown area on 12 September 2017. The list goes on. These outages profoundly impact not only the airport and airline involved (as well as the LRT when that is involved), but also the associated airline alliance.

Airport alliances crisscross the globe. As of November 2016, Star Alliance became the largest global alliance by passenger count with 689.98 million passengers. SkyTeam (the last of the three major airline alliances to be formed, as the first two major airline alliances to be formed were Star Alliance and Oneworld) followed with a passenger count of about 665.4 million, and Oneworld followed with a passenger count of approximately 557.4 million. As of November 2017, Star Alliance’s 27 member airlines operate a fleet of 4,657 aircraft and serve 1,330 airports in 192 countries. As of March 2014, SkyTeam’s member airlines operate a fleet of 3,054 aircraft and serve 1,074 airports in 177 countries. As of October 2017, Oneworld’s member airlines operate a fleet of 3,447 aircraft and serve 1,012 airports in 158 countries. Airports Council International (ACI) issued its preliminary world airport traffic rankings, which points out "robust gains” in passenger traffic at hub airports serving trans-Pacific and Southeast Asian routes. Indeed, the following airports in the Indo-Asia-Pacific are becoming the world’s busiest and fastest growing airports: Tokyo International Airport (a.k.a. Haneda Airport) in Tokyo, Japan, which grew 5.5% in total passenger traffic and is the world’s fourth busiest airport and Japan’s largest; Shanghai Pudong International Airport in Shanghai, China, which grew 9.8% in total passenger traffic and is the world’s ninth busiest airport; Incheon International Airport in Seoul, South Korea, which grew 17.1% in total passenger traffic and is the world’s nineteenth busiest airport and South Korea’s largest. So, what is being done with regards to the energy-infrastructure at these hub airports? It is a challenge, but something is being done.

Albeit on a modest scale, Vit Tall P3I has endeavored to place investments into areas that have supported enhancing the resiliency of airports and LRTs.

Generally speaking, interest by members of Vit Tall P3I in Southeast Asia (SEA) traces back to 2005, but active engagement with the Association of Southeast Asian Nations (ASEAN) began in 2011. Indeed, according to J.P. Morgan, the ASEAN has been "fast becoming a major economic force in Asia and a driver of global growth." The criticality of the ASEAN on the world stage is clear. As a point in fact, the ASEAN Infrastructure Fund (AIF) was established as a dedicated fund by the Asian Development Bank (ADB) as well as ASEAN member nations "to address the ASEAN region's infrastructure development;" of note, all of the AIF-financed infrastructure projects are also co-financed with ADB funds. In addition to the ADB, another bank was launched, the Asian Infrastructure Investment Bank (AIIB), to support infrastructure projects in the region. Yet, even with the AIF/ADB and AIIB, the ADB forecasts that there still exists a USD$8 trillion infrastructure deficit.

Therefore, we examine a smaller study space to see if there is a smaller, more manageable infrastructural gap that can be filled. As one opportunity, within the ASEAN, the East ASEAN Growth Area (EAGA), a subregional economic cooperation initiative among Brunei and the three mega-diverse countries (Indonesia, Malaysia, Philippines) of the Malay Archipelago as well as Timor Leste, has been of particular interest due to the interesting amalgam of these growth economies; this segment is referred to as the Brunei, Indonesia, Malaysia, Philippines, Timor Leste-East ASEAN Growth Area (BIMPT-EAGA). The BIMPT-EAGA has economic corridors or cross-border value chains that are intriguing for investment; in essence, there is the possibility for infrastructure gap investments that would have a much greater impact than otherwise would have been possible, via investment in just one of the BIMPT-EAGA countries. Vit Tall P3I has placed investments within the BIMPT-EAGA. As an extension of these efforts (and of those countries increasing their involvement in BIMPT-EAGA's development), Vit Tall P3I has placed investments into Japan, and along the BIMPT-EAGA vein, Vit Tall P3I has also placed investments into other subregionals, such as the Indonesia-Malaysia-Thailand Growth Triangle (IMT-GT), which includes the countries named, and the Greater Mekong Subregion (GMS), which includes Thailand and Laos. Vit Tall P3I also has planned investments with IMT-GT trading partners, which are Asia-Pacific Economic Cooperation (APEC) countries, such as Taiwan. Yet, throughout the region, despite the clear need, the growth economies, the promising market, the governmental and intergovernmental funding mechanisms, and the economic corridors, there still remains an energy-infrastructure investment gap and an underinvestment by the private sector.

Vit Tall P3I has endeavored to “prime the pump” by hoping to serve as the grain of sand, such as in the Bak-Tang-Wiesenfeld (BTW) Theory of Equilibrium, wherein a single grain of sand might start a chain reaction and cause an avalanche within the sand pile.

Southeast Asia (SEA) consists or two geographic regions: Mainland Southeast Asia (a.k.a. Indochina) and Maritime Southeast Asia (a.k.a. East Indies or Malay Archipelago). Indochina consists of Cambodia, Laos, Myanmar, Thailand, Vietnam, and West Malaysia. The East Indies or Malay Archipelago consists of Andaman and Nicobar Islands, Brunei, Christmas Island, Cocos (a.k.a. Keeling Islands), East Malaysia, East Timor, Indonesia, Philippines, and Singapore.

Association of Southeast Asian Nations (ASEAN) consists of ten SEA countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar (Burma), Philippines, Singapore, Thailand, and Vietnam.

East ASEAN Growth Area (EAGA) is a sub-regional economic cooperation initiative of five SEA countries: Brunei, Indonesia, Malaysia, Philippines, and Timor Leste (BIMPT).

The Malay Archipelago is largest group of islands in the world, consisting of the more than 17,000 islands of Indonesia, the approximately 7,000 islands of the Philippines, and the island portion of Malaysia.

Brunei, Indonesia, Malaysia, Philippines, Timor Leste-East ASEAN Growth Area (BIMPT-EAGA) is a a subregional economic cooperation initiative within SEA.

Asia-Pacific Economic Cooperation (APEC) consists of 21 Pacific Rim member economies that promote free trade throughout the Asia-Pacific region: Australia, Brunei, Canada, Chile, China (i.e. People’s Republic of China), Hong Kong (China), Indonesia, Japan, Malaysia, Mexico, New Zealand, Papua New Guinea, Peru, Philippines, Russia, Singapore, Republic of Korea, Taiwan (a.k.a. Republic of China or Chinese Taipei), Thailand, United States, and Vietnam.

Indonesia-Malaysia-Thailand Growth Triangle (IMT-GT) is a subregional program that aims to stimulate economic development in 32 of the less-developed states and provinces within the 3 countries; these 32 states and provinces include 14 provinces of southern Thailand (Krabi, Nakhon Si Thammarat, Narathiwat, Pattani, Phattalung, Satun, Songkhla, Trang, Yala, Chumphon, Ranong, Surat Thani, Phang Nga, and Phuket); 8 states of northern Peninsular Malaysia (Kedah, Kelantan, Melaka, Negeri Sembilan, Penang, Perak, Perlis, and Selangor), and 10 provinces of Sumatra, Indonesia (Aceh, Bangka-Belitung, Bengkulu, Jambi, Lampung, North Sumatra, Riau, Riau Islands, South Sumatra, and West Sumatra).

The Greater Mekong Subregion is a natural economic area bound together by the Mekong River and includes six member countries: Cambodia, China (People's Republic of China, specifically Yunnan Province and Guangxi Zhuang Autonomous Region), Laos, Myanmar, Thailand, and Vietnam.

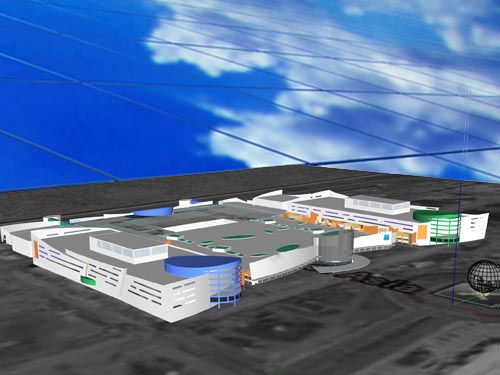

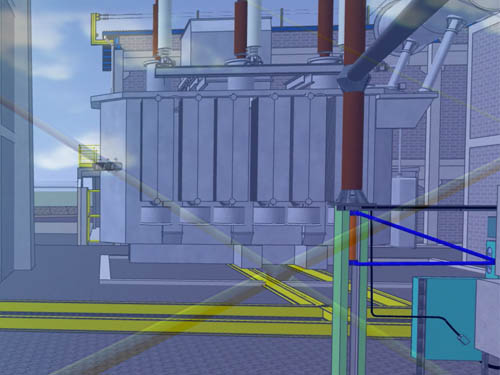

Archipelagic Grids (i.e. island grids) are quite different from the grids of continental expanses: (1) The transmission distances are shorter, and less interconnected (compared to the mainland areas); (2) the black start and quick start capabilities are less robust; (3) island grids are exhibiting higher deployments of Renewable Energy Sources (RES), and these RES units (e.g. photovoltaics) do not provide mechanical inertia; therefore, the inertia of these systems is lower than that of systems with conventional generators and rotating machinery that provide rotational inertia. Accordingly, frequency dynamics are faster in power systems with low rotational inertia, thereby making stability operations more challenging. Accordingly, simply deploying off-the-shelf solutions may not be effective. For this reason, Vit Tall P3I has made select strategic investments to facilitate more robust solution sets. Thus far, the investments of time and money have been with regards to aspects of: (1) an Infrastructural “[Experimental] Sandbox Laboratory,” (2) an Infrastructural “Security Laboratory,” (3) an Infrastructural “Telemetry Laboratory,” and (4) an Infrastructural “Analysis Laboratory.”

Vit Tall P3I has endeavored to place investments into higher-risk areas that others might shy away from; however, respectfully speaking, Vit Tall P3I believes that these strategic areas are critical for facilitating a truly value-added proposition solution set.

Black Start With regards to black start, under normal circumstances, the electric power used within a power plant (i.e. power station) is provided from the main power generators at the station. However, if the station’s main generators are shut down, the station’s power is provided by drawing power from the grid, via the station’s incoming transmission line. However, during a wide-area power outage, off-site power supply from the grid will not be available. In the absence of grid power, a “black start” needs to be performed. To provide a black start, some stations have small diesel generators (a.k.a. black start diesel generators or BSDGs), which can be used to start larger generators (e.g. of several megawatts capacity), which in turn can be used to start the main generators at the station.

Quick Start With regards to quick start (a.k.a. fast start), it refers to the ability of the power plant to reach full power from a cold start, which refers to the condition wherein the involved generator(s) has been in stop/stand-by condition for more than 20 hours.

Southeast Asia (SEA) consists or two geographic regions: Mainland Southeast Asia (a.k.a. Indochina) and Maritime Southeast Asia (a.k.a. East Indies or Malay Archipelago). Indochina consists of Cambodia, Laos, Myanmar, Thailand, Vietnam, and West Malaysia. The East Indies or Malay Archipelago consists of Andaman and Nicobar Islands, Brunei, Christmas Island, Cocos (a.k.a. Keeling Islands), East Malaysia, East Timor, Indonesia, Philippines, and Singapore.

Association of Southeast Asian Nations (ASEAN) consists of ten SEA countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar (Burma), Philippines, Singapore, Thailand, and Vietnam.

Indo-Asia-Pacific or Indo-West Pacific or Indo-Pacific is increasingly being utilized as a term within strategic, geo-political discourse around the world. It refers to the region consisting of the Indian Ocean, the western and central Pacific Ocean, and the seas connecting these oceans in the general area of Indonesia. The Indo-Pacific is also categorized into three realms: (1) Central Indo-Pacific (encompasses the seas and straits connecting the Indian and Pacific oceans and the seas surrounding the north coast of Australia, the Indonesian archipelago (with the exception of Sumatra's northwest coast, which is part of the Western Indo-Pacific), Philippine Sea, and the South China Sea as well as the seas surrounding Fiji, central/western Micronesia, New Caledonia, New Guinea, Solomon Islands, Tonga, and Vanuatu), (2) Eastern Indo-Pacific (encompasses the volcanic islands of the central Pacific Ocean and spans the Marshall Islands and central/southeastern Polynesia as well as Easter Island and Hawaii), and (3) Western Indo-Pacific (encompasses the central/western portion of the Indian Ocean and spans the east coast of Africa, Andaman Sea, Arabian Sea, Bay of Bengal, Gulf of Aden, Persian Gulf, Red Sea, and the coastal waters surrounding Chagos Archipelago, Comoros, Madagascar, Maldives, Mascarene Islands, and Seychelles).

Over the past several years, Vit Tall P3I has examined the infrastructural aspects/dimensions of strategic infrastructure investment decisions in airport and rail, and it has noticed the decision-making challenges of prudent macro-economic planning versus efficient micro-economic management for major projects. Oftentimes, difficult decisions are made in those complex, major projects that result in paradigms that leave much room for improvement, particularly as pertains to resiliency. This also extends to other big projects, such as sports complexes for major venues.

In recent times, power outages have affected numerous airlines and airports. Members of Vit Tall P3I had witnessed the 9-hour power outage affecting San Diego International Airport (a.k.a. Lindbergh Field) on 25 May 2013. This particular incident helped to propel the members’ efforts to better understand the vulnerabilities of airlines and airports around the world. On 10 October 2013, colleagues of the members were impacted by a power outage, which caused major delays at London-Stansted Airport. On 27 March 2015, colleagues of the members were impacted by a power outage, which struck the Amsterdam Airport Schiphol. On 8 August 2016, Delta Air Lines suffered an information technology (IT) systems failure due to a power outage and stated that it had lost $150 million in revenue as a result. On 27 May 2017, a power outage at the British Airways data center caused an IT systems failure that resulted in more than a $100 million in lost revenue and the expense of accommodating, re-booking, and compensating thousands of passengers. More than 50 airports across Japan were affected when the national airline carrier, All Nippon Airways (ANA), experienced an outage of its IT systems on 21 March 2016. On 13 June 2017, a power failure delayed Garuda Indonesia flights at Soekarno-Hatta International Airport. On 24 September 2017, all flights at Sydney Airport were grounded due to a power outage. On 17 December 2017, Atlanta’s Hartfield-Jackson International Airport, the world’s busiest airport, experienced a power outage that led to more than a thousand flight cancellations and stranded thousands of passengers in the dark for more than 11 hours.

Clearly, the economic impact of power outages of airlines and airports is considerable. Taking the power outages of just one airline affected by a power outage in 2016 (Delta Air Lines) and just one airline affected by a power outage in 2017 (British Airways), the aggregate estimated economic losses total more than United States Dollars (USD) $250 million. Yet, despite the stark financial consequences at play, power outages continue to occur, such as in the case of the London-Stalsted Airport, which experienced recurring power outages on 10 October 2013, 22 December 2014, and 9 May 2017. Likewise, Delta Air Lines suffered from recurring power outages in Atlanta on 7 September 2016 as well as 17 December 2017.

There is a common denominator among the numerous, highly variegated countries throughout Southeast Asia. Due to geographical and historical reasons, the region is very much underserved by rail. Many of the railways in the regions, especially those of India, Bangladesh, and Indochina (Cambodia, Laos, Myanmar, Thailand, Vietnam, and West Malaysia), were built during colonial times (the historical period of a country when it was subject to administration by a colonial power) on a metre-gauge single track, and that paradigm has generally persisted.

Of the world’s total rail track, metre-gauge (1,000 mm or 3 ft, 3 and 3/8 in) is the narrowest and the least used of the 5 main gauges. Standard gauge (1,435 mm or 4 ft, 8 and 1/2 in) is used for approximately 55% of the world’s track. In contrast, metre-gauge is used for approximately 7% of the world’s track. In general, single track makes two-way traffic within the system extremely challenging, and as it is generally classified as "non-standard gauge," interoperability and interconnections with neighboring rail systems is made challenging.

With respect to Indochina, the railways of Vietnam and Cambodia were built during colonial times and have fallen into a state of disrepair. With respect to the Malay Archipelago (Andaman and Nicobar Islands, Brunei, Christmas Island, Cocos or Keeling Islands, East Malaysia, East Timor, Indonesia, Philippines, and Singapore), taking just Indonesia and the Philippines, limited infrastructure funds need to be shared among thousands of island, so developing capital-intensive projects, such as rail, is challenging. In fact, countries throughout Southeast Asia have experienced rail issues. Atop these complications, power outages also complicate matters for rails. For example, Bangkok’s Airport Rail Link, which links Bangkok, the capital city of Thailand, to Bangkok’s main international airport, experienced a power outage on 21 March 2016. The Central Puget Sound Regional Transit Authority (a.k.a. Sound Transit) of Seattle, Washington experienced a power outage on 8 August 2017. Amtrack and New Jersey Transit trains experienced a power outage on 1 January 2018 and 11 February 2018 at Penn Station in New York, New York. Metro-North Commuter Railroad, which connects New York City to its northern suburbs and Connecticut, experienced a power outage on 6 March 2018.

Power outages at sports complexes during major venues have also occurred, such as during Super Bowl LXVII (the game has since earned the nickname, the "Blackout Bowl") on 3 February 2013 at the Mercedes-Benz Superdome in New Orleans, Louisiana and during the Superclásico de las Américas (a.k.a. Doctor Nicolás Leoz Cup) soccer match on 3 October 2012 at the Centenario Stadium in Resistencia, Argentina. Power outages in certain locales have called into question their ability to host major global sports events. By way of example, given Brazil's "blackout crisis," there were concerns about Brazil's capability to host the 2014 Fédération Internationale de Football Association (FIFA) World Cup soccer tournament and the 2016 Summer Olympics (officially known as the Games of the XXXI Olympiad and commonly known as Rio 2016). There are pathways to mitigate these outages. For example, there are some electric utilities that can provide a distribution feeder with a higher level of reliability. Such feeders may have been recently upgraded and are either dedicated lines from a substation or are lines that are shared by only one or two customers. Such feeders may also have historical power quality data available for analysis, thereby providing an indicator for their reliability. In some cases, customers may opt to pay a premium price for this “dedicated” service, which not be a "silver bullet" solution. However, given the infrequent use of most arenas and stadiums, oftentimes, this is not the case.

+1 855 500 9205

investments@vittallpartners.com